Why I am Raising My Prices?

Toronto Real Estate Market

In this video, I show you why I am RAISING my PRICES on my Toronto Condo Listings.

Summary

These are the three main reasons why I am raising my prices:

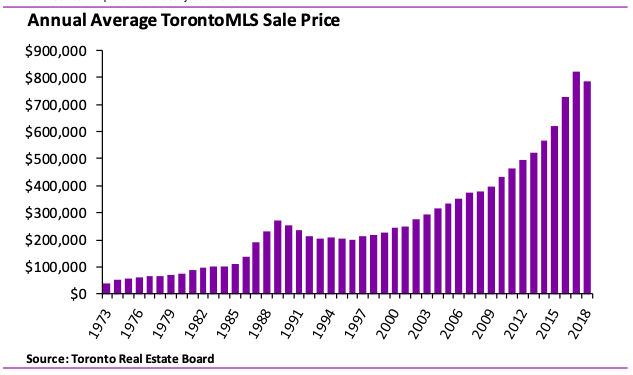

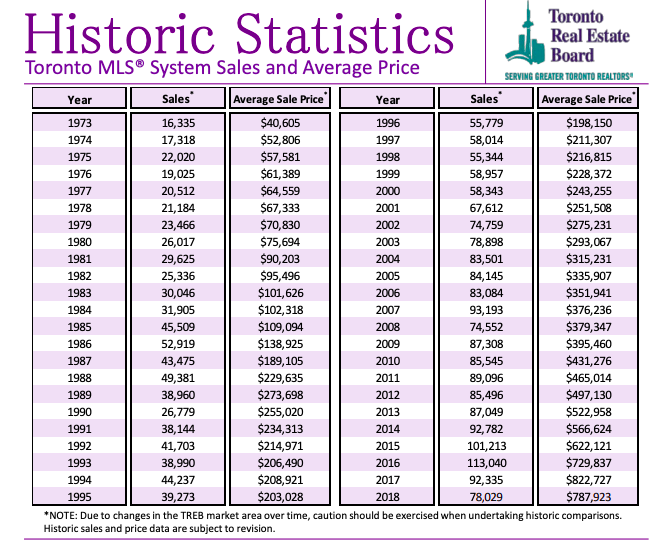

- The Toronto Real Estate Market has increased by 10% from June 2018. Supply and Demand are still out of balance (and will keep for a long time IMHO). 2019 Will likely see an increase of 10%-15% in prices, and some areas in Toronto will likely see higher gains.

- Inflation causes all prices to go up, all the time – printing money devaluates it.

- Immigration to Canada – immigrants arriving in Canada with USD to secure properties get a 35% discount on our prices! That in turn, raises prices for everyone that is already living and working in Canada (born in Canada or first gen immigrants).

Toronto Real Estate Prices 1973-2019

Toronto Real Estate Stats 1973-2019

Why are Toronto Real Estate Price So High?

The Toronto Real Estate Market has been on fire for years. Many simply cannot fathom what is going on. Nonetheless, it is a reality that we need to understand and adjust to. Here are my views on the matter, feel free to comment below with your own ideas (trolls – I love you too!)

Supply and Demand

Toronto needs more beds. There are not enough beds (bedrooms) in Toronto. The city’s population is constantly growing, you can feel it walking down the streets, sitting in traffic or getting in line at any store – there are people everywhere and there see to be more every day. That is correct. All these people need a place to live, and we have not enough good options. As long as the population exceeds the amount of beds available, prices will continue to rise. It’s basic.

Inflation

Have you noticed that prices always go up? The price of everything goes up, always: lemons, tomatoes, bananas or condos. Prices go up. Why is that? Why can we not simply have the same price? The answer is: inflation. Inflation means that the money you have today, can buy less tomorrow. Inflation is created when we print more money. If today we have one dollar, and we print another, the value of these two dollars is halved – equal to the value of the single dollar we had before Same is with Real Estate – when our money is worth less, we need more of it, so prices go up. There is nothing you can do about inflation by itself – but you can hedge by buying Real Estate or other appreciating assets.

Immigration

Canada is a country of immigrants – I am one, too. Canada needs immigrants to do grunt work, add skills and labour and bring money in. Most immigrants to Canada must have significant amount of dollars in order to receive papers. That is great to ensure that newcomers are established and won’t be a strain on our society. However, there is another side to the coin – rich immigrant usually bring USD, and when converting their USD to CAD, they get a 35% discount (bc our dollar is worth less than USD). They then turn and purchase what seems to them as “cheap real estate” – and able to pay full price or beat any other bidders in order to secure a house or a condo.

The unintended result is that locals who make their income in CAD cannot compete – as houses and condos get snapped by highest bidders, fuelled with foreign funds, locals find themselves priced out, they can no longer afford what they could earlier.

Quality Condos and Homes help preserve the value of your investments.

How to Beat The Toronto Real Estate Market:

There are several ways available to investors. Let me describe the most common methods of preserving and increasing the value of your money, through Real Estate Investing:

- Pre-Construction – buying pre-con condos (and homes) is the mot popular method investors use. It is popular bc it enables investor to deposit only 15-20% of the condo’s value, wait a few years until it appreciates and then assign it for profit, or close and enjoy cashflows.

- Assignments – many assignments are sold at discount (over market prices). You could grab an assignment for less than what it should be worth, and immediately make the margin. However, you may require more cash (than option #1) and you need to close on the unit.

- Re-Sale – buying a re-sale (existing) property is usually cheaper than buying pre-construction. You can buy a condo on the open market for 20-40% LESS than you’d pay for a new one. Take for example King West – you can still find re-sale condos for $1,000-$1,200/ft whereas new condos in the are go for $1,400-$1,800/ft. Thats a huge margin. Of course, you’ll need to close on it and get a tenant or move in yourself.

Remember to perform a strict due diligence, checks and balances, and make sure you get professional advise. No investment is automatic, and not all investors are successful, so watch out for that and do your homework.

What to Watch For:

Every investment has a risk built in to it – otherwise it won’t be in investment. If you wanted “a sure thing” you’d better buy GICs for 1-2% a year. Of course, that would result in a nominal loss as inflation is higher than what the bank will grant you. In essence, GICs (and similar offerings) typically result in a loss – even though on paper you have “more money”.

You also need to be careful who you are dealing with. Is your agent in the business full time and long term Do they own Real Estate themselves? Are they renters or owners? How much experience do they have? Are they doing their best to show you good options or pushing you towards specific ones?

Finally, be realistic about your goals and financial status. Prepare to purchase what you can, not what you cannot. So many “investors” are asking me about properties they clearly cannot afford, and they know it. It’s great to empower yourself with knowledge but when it comes down to action, you need to be realistic and focus on what you can do, right now.

Take Action!

Over the years, I’ve had thousands of people contacting me. Some send questions year after year, but take no action, they own nothing. By now, they could have owned one, two or four condos. But they are still renting and have nothing to show for it. In order to get ahead, you must take action. It takes work, preparation, and many steps – there is no free lunch, but your lunch will taste amazing when you earned that lunch money from smart investing. Can you get there? Those who are, are more wealthy every day.

Want to one? Take action!

Where To Go From Here?

Your next step is to contact me. Lets have a. chat and dive into your dreams and wishes. We will set up a plan for your to become a successful Real Estate investor. That’s what I do, I help people invest in Toronto Real Estate and prosper.